About Us | Contact Us | Carriers Represented | Consumer Info | FAQ | Glossary Site Map

Auto Insurance

- What to do in the event of an auto accident

- My teenage child is about to get a learner’s permit. When do they need to be added to my policy?Drivers are added to the personal auto policy when their license is issued, not when they get their learner’s permit.

- My teenage child will have his own car. Should I insure it in the child’s name on a separate policy or add it to my existing policy?As a general rule, it is less expensive to insure a child on the parent’s policy rather than on a separate policy in the child’s name. Remember that the title and the name on the policy need to agree.

- The body shop is repairing my vehicle after an insured loss. Will my insurance company pay for used or new parts?If the repair of the damaged part impairs the operational safety of the vehicle, then the insurance company will pay to replace it with a new part. But, for non-safety parts, unless your claim occurs during the first year after your car was manufactured, you are not entitled to new ones. This means that a three-year old door will not get replaced by a brand new one.

Homeowners Insurance

- What is Homeowner’s Insurance?

There are two types of Homeowners Insurance, Named-Peril Insurance and All-Risk Insurance. The first one pays only for the causes of loss specified in the policy. All-Risk Insurance covers losses except those specifically excluded in the policy. - How do I get the lowest rates?

Insurers frequently award lower rates to homeowners who guard against theft, accidents and other losses by using such devices as alarm systems. Some companies provide discounts to premium multiple-policy holders (home and auto or life). - My neighbor’s tree blew onto my fence. Shouldn’t he be responsible for repairing the damage?

Your neighbor is only responsible for the damage if there was something about the tree that should have alerted your neighbor to the fact that it represented a dangerous condition. If an “act of God” causes an otherwise healthy tree belonging to your neighbor to damage your property, you will need to look to your own policy (and your own deductible) for coverage.

Flood Insurance

- Do I have to live in a designated flood zone in order to purchase flood insurance?No. Most properties are eligible for flood coverage. It is not a requirement that you live in a flood zone in order to purchase flood insurance.

- Will flood insurance cover me if my basement “floods” after a heavy rain.Unless your basement floods as a result of general flooding in the area, there is no coverage under a flood policy for seepage of water into a basement.

Life Insurance

- What types of life insurance are available?

There are two types of life insurance that are available, term insurance and permanent insurance. Term insurance provides protection for a specific term of one or more years. It is called term since it’s only for a specific time period. Death benefits are paid only if you die within the term of years for which the policy is written. You can renew term insurance but your premium will be higher each time since you get older. Permanent insurance exists as long as you live. The premium costs are averaged over your life time, so it doesn’t ever increase. However, the premium is higher than that of term insurance. - Do I have to take a physical exam in order to get life insurance?

Some life insurance companies offer non-medical life insurance which is when you only have to answer questions in an application. However, based on your answers on this application, you might be required to take a physical examination if you have seriously impaired health or an existence of a terminal illness. If you refuse to take an examination, the company has the right not to see you a policy. - What can I do if an insurance company rejects my life insurance application?

Each company has its own underwriting standards. Underwriters decide which applicants for insurance are accepted and which are rejected. If a company refuses to insure you, make sure to shop around; keeping in mind that companies do not need to provide life insurance for you. - What is life insurance designed for?

Life insurance is designed to help you deal with the financial impact of some of life’s unexpected events. It ensures that when you die, your family will have the financial resources it needs to meet its expenses. - Why do people purchase life insurance?

Many people purchase life insurance to accumulate funds for future needs such as retirement, college or simply for future emergencies.

Commercial Insurance

- What is commercial insurance?

Your business represents a major investment of time, money and resources. To protect this investment, there are many coverages to choose from. In addition, most states require a business to provide coverage for your employees in case of on-the-job injuries.

Home| About Us | Contact Us | Carriers Represented | Consumer Guides | FAQ | Glossary

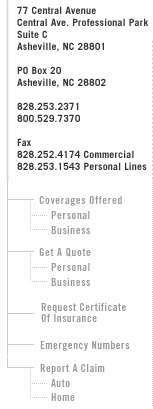

Get A Quote | Report A Claim | Coverages Offered